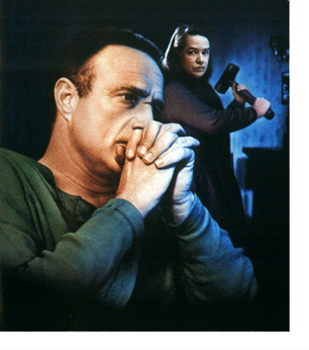

It’s a timely topic, but when asked to detail my experience with Chapter 11, the line that came to mind was from the end of ‘Misery’, when James Caan is lunching with his agent: “Gee, if I didn’t know better, I’d think you were asking me to dredge up the worst horror of my life, just so we could make a few bucks.” But though I never hope to put the experience to use again, it provided valuable lessons (plus, my company — Lattice Semiconductor — prevailed, and grew to a quarter-billion dollars in sales) and serves as a cautionary tale to entrepreneurs as we enter some tough times ahead.

It’s a timely topic, but when asked to detail my experience with Chapter 11, the line that came to mind was from the end of ‘Misery’, when James Caan is lunching with his agent: “Gee, if I didn’t know better, I’d think you were asking me to dredge up the worst horror of my life, just so we could make a few bucks.” But though I never hope to put the experience to use again, it provided valuable lessons (plus, my company — Lattice Semiconductor — prevailed, and grew to a quarter-billion dollars in sales) and serves as a cautionary tale to entrepreneurs as we enter some tough times ahead.

So here is the tale — of a company that ran up expenses too far ahead of revenue, hit the wall, then succeeded with a ‘do-over’ by putting one of America’s great pieces of legislation — the 11th Chapter (Reorganization) under Title 11 (Bankruptcy) of the United States Code — to work.

________

The old regime ousted, my new CFO and I (promoted to COO) — several months into a salary moratorium, since the company was down to the very last of its cash — were on a mission to raise fresh capital. First on our list of VCs was NEA, and we were hiking up Knob Hill (ridiculous, but we were trying to save cab fare) to the exclusive San Francisco club where the Sand Hill Road VCs had deigned to meet us. We hurried through the massive portico, past — was that a cellist? — down a triple-wide marble staircase to an enormous room with nothing but an easel and elegantly set table.

But we weren’t to dine that day.

The VCs motioned to us just as lunch was being served, and we earnestly began the pitch for our hot computer-chip company. But by the time we realized we weren’t getting fed, it was pretty clear they weren’t going to invest either.

What we did give us that day was a lesson — etched forever in my memory of pristine crystal and gilt-edged china on crisp linen. (Was it because it served as so perfect a metaphor for the venture capitalist ideal . . . or were we just hungry?)

“œWe VCs like to pull ourselves up to a fresh table,” the lead partner said, stroking the linen and aligning his silverware for emphasis. “œYou’re going to have to clean house.”

We knew what he meant — or thought we knew. Though we had sales exceeding $1M a quarter and referenceable customers like Compaq, we had problems. A burn rate that would snap your neck, for one — $750k a month, anchored by a 10-year building lease and a crushing debt load. Then there was that undigestible shareholding of my megalomaniacal co-founder, whom we had forced out only weeks before: an eye-popping 35% ownership in the company.

These were problems we naïvely believed a fresh round of financing could fix. But the VCs had dosed us with reality that day. Despite how hard we’d worked to get where we were — endured three months without pay . . . gritted through laying off a third of our 175 employees . . . pulled off the board coup and CEO ouster — the barons of Sand Hill Road had declared us unfundable. To pound the table-setting metaphor one last time: we were the morning after a bacchanalian orgy.

The Unutterable

Back at our offices, none dared utter ‘Chapter 11’ outside the board room. It wasn’t shame we feared, but the booming voice of conventional wisdom: as a chip company, you’re dependent not just on intellectual property, but on know-how — an asset buried deep in the neurons of key engineers. Spook them, and you’re liable to ‘lose the recipe.’ (The semiconductor business is legendary for nuances wildly affecting yield, also known as KGD or known good die per wafer — the all-important metric that dictates profit and loss.) The thinking was, if you so much as mention Chapter 11, key employees flee, production goes to hell, and you’re left with . . . nothing.

Management and investors gnashed and thrashed over whether to file. While the Code was drafted with us in mind — keeping the creditors at bay and allowing you to conduct business as usual as you work out a plan to repay them — we couldn’t get over our fears. So, like others before (and many to follow), we came to an ill-informed conclusion: We’ll work everything out without filing for Chapter 11. Surely everyone will go along with it, since it will have a much better chance of success! Who wouldn’t prefer it to being crammed down by a curmudgeonly bankruptcy judge? It will be so much more . . . civil!

Only, it doesn’t work that way. Next in Part 2: Hard Lessons in the Chapter.